These days, there are various ways and reasons for individuals, organizations, and brands to raise funds.

Three of the most popular options that have gained significant traction are:

- crowdfunding

- peer-to-peer lending

- peer-to-peer fundraising

To people who don’t have a lot of experience with online fundraising, these three options might seem like the same thing. However, each of these strategies offers its own unique advantages and considerations. When it comes to raising money, choosing the right option will depend on the specific needs and goals of your project or cause.

This article will explore the key aspects of crowdfunding, peer-to-peer lending, and peer-to-peer fundraising to help you decide which is right for you and maximize your chances of success.

Contents

What is crowdfunding?

Crowdfunding has emerged as an ideal fundraising method for various individuals, groups, and organizations. Its versatility and accessibility have revolutionized how people gather financial support and bring their creative visions to life.

Let’s explore some additional contexts where crowdfunding can be a game-changer:

- Research and Innovation: Scientists, researchers, and innovators increasingly use crowdfunding platforms to finance their projects. Whether it’s a groundbreaking medical research study, a sustainable technology prototype, or an environmental conservation initiative, crowdfunding allows these visionaries to bypass traditional grant applications and directly engage with a global community of like-minded supporters who value their work.

- Educational Initiatives: Crowdfunding has proven to be a lifeline for educators and educational institutions seeking additional resources for innovative teaching methods, extracurricular programs, and scholarships. It empowers teachers and students alike to rally their networks and advocate for causes that enhance the learning experience.

- Product Development: Startups and inventors can leverage crowdfunding as a cost-effective way to test the market demand for their products. By launching a crowdfunding campaign, they can gauge interest, secure pre-orders, and receive valuable feedback from early adopters, all while raising the necessary funds to bring their creations to market.

- Community Projects: Local communities often face challenges that require financial support, such as building a community center, revitalizing public spaces, or funding disaster relief efforts. Crowdfunding platforms empower residents to take ownership of their community’s needs and rally together for a common cause.

- Personal and Medical Expenses: In times of personal crisis or medical emergencies, crowdfunding provides a compassionate way for individuals and families to ask for help and support. Whether it’s covering medical bills, funeral expenses, or other unforeseen hardships, crowdfunding campaigns can serve as a powerful safety net and alleviate financial burdens.

- Cultural Heritage and Preservation: Organizations dedicated to preserving cultural heritage sites, traditions, and historical landmarks can utilize crowdfunding to raise funds for restoration and conservation projects. It allows people worldwide to contribute to protecting invaluable cultural assets, regardless of their geographical location.

- Environmental Sustainability: With increasing awareness of climate change and ecological issues, crowdfunding has driven green initiatives. From tree planting campaigns to sustainable farming projects, individuals and environmental organizations can unite efforts and work towards a greener and more sustainable planet.

- Small Businesses and Local Initiatives: Beyond startups, established small businesses can also benefit from crowdfunding to expand their offerings, open new locations, or invest in sustainable practices. Additionally, crowdfunding can boost local initiatives to support and promote small businesses within a community.

- Product Testing and Prototyping: Entrepreneurs and inventors can use crowdfunding to raise funds and gather valuable insights from backers during the early stages of product development. They can iterate on their prototypes through surveys and feedback mechanisms and create products that better align with customer needs and preferences.

- Cultural and Artistic Exchanges: Crowdfunding can facilitate cultural exchange programs and artistic collaborations by providing the necessary funds for travel, accommodation, and production expenses, promoting cross-cultural understanding, and fostering international cooperation in art, music, theater, and other creative disciplines.

What is peer-to-peer lending?

Peer-to-peer lending, or P2P lending, has emerged as a disruptive force in the financial industry, transforming how individuals and small businesses access loans. This innovative lending model connects borrowers directly with individual lenders through online platforms, bypassing traditional financial intermediaries like banks.

Here’s a deeper look at the advantages and key beneficiaries of peer-to-peer lending:

- Diversification of Investment: P2P lending opens up new investment opportunities for individuals looking to diversify their portfolios. Lenders can allocate their funds across a range of borrowers and loans, spreading their risk and potentially earning attractive returns that outperform traditional savings accounts.

- Competitive Interest Rates: P2P lending often offers borrowers more competitive interest rates compared to traditional banks, especially for those with good creditworthiness. The absence of a physical branch network and lower overhead costs for P2P platforms contribute to these cost savings, which can be passed on to borrowers.

- Quick and Convenient Process: P2P lending platforms typically offer a streamlined application and approval process. Borrowers can submit loan requests online and, if approved, receive funding faster than the lengthy procedures of traditional banks.

- Transparent Terms and Fees: P2P lending promotes transparency by clearly stating upfront loan terms and associated fees. Borrowers can make informed decisions without hidden charges or sudden rate adjustments.

- Creditworthy Individuals with Unique Circumstances: P2P lending platforms often use alternative credit criteria, allowing creditworthy individuals who may not fit the rigid standards of traditional banks to access funding. This especially benefits young adults with limited credit history, immigrants, or self-employed individuals.

- Unsecured Personal Loans: P2P lending predominantly offers unsecured personal loans, meaning borrowers do not need to provide collateral, such as a home or vehicle, reducing the risk of losing valuable assets if they encounter difficulties repaying the loan.

- Debt Restructuring: P2P lending facilitates debt consolidation. In this process, borrowers can merge multiple high-interest debts into a single loan with a potentially lower interest rate. This restructuring can simplify finances, improve cash flow, and reduce the overall cost of debt.

- Small and Medium-sized Enterprises (SMEs): P2P lending has become an attractive funding option for small businesses seeking capital to expand, purchase inventory, or invest in new projects. It can serve as a lifeline for SMEs that face challenges securing loans from traditional banks due to stringent requirements.

- Improved Access to Finance: P2P lending has expanded financial inclusion in many regions by offering loans to previously underserved population segments, including individuals in rural areas or low-income communities who can now access credit for personal or business needs.

- Social Impact Investing: Some P2P lending platforms focus on social impact investing, where lenders support projects and initiatives with a positive social or environmental impact, allowing investors to align their financial goals with their values and contribute to meaningful causes.

What is Peer-to-Peer fundraising?

Peer-to-peer fundraising, or P2P fundraising, has become a dynamic and effective strategy for rallying support and raising funds across various sectors. This engaging approach harnesses the power of social networks and personal connections to create a far-reaching impact.

Here are some of the groups that benefit the most from peer-to-peer fundraising:

- Crowdfunding for Personal Causes: Individuals facing unexpected medical expenses, natural disasters, or personal emergencies can find solace in peer-to-peer fundraising. Friends, family, and acquaintances can unite to provide financial assistance during challenging times, making a significant difference in the lives of those in need.

- Grassroots and Community-Driven Initiatives: P2P fundraising can be a catalyst for local community projects and events. From revitalizing public spaces to supporting school programs and extracurricular activities, community members can actively participate in fundraising efforts and take ownership of projects that enrich their neighborhoods.

- Nonprofit Organizations: For nonprofits, peer-to-peer fundraising has emerged as a game-changing tool to expand their reach and donor base. By empowering existing supporters to advocate for the cause, nonprofits can tap into new networks of potential donors, amplifying their impact and establishing long-term relationships with passionate advocates.

- Awareness Campaigns: P2P fundraising is not just about financial contributions; it also helps raise awareness for critical issues. Individuals running advocacy campaigns or promoting social causes can leverage their networks to spread the message far and wide, sparking conversations and generating support.

- Educational Institutions: Schools, colleges, and universities can benefit from peer-to-peer fundraising to support scholarships, fund research projects, or improve campus facilities. Students, alums, and faculty can rally together, fostering community and pride in their alma mater.

- Cultural and Artistic Endeavors: Artists, musicians, and cultural organizations can embrace peer-to-peer fundraising to finance creative projects and cultural events. This approach provides financial backing and builds a dedicated community of fans and supporters who champion the arts.

- Faith-Based Initiatives: Religious organizations often rely on the support of their congregation to carry out charitable work and community outreach. Peer-to-peer fundraising allows faith community members to contribute to the initiatives they care about most.

- Animal Rescue and Welfare: Animal shelters and rescue organizations often depend on the kindness of animal lovers to fund their operations. Peer-to-peer fundraising enables supporters to raise funds for medical care, adoption drives, and rescue missions, saving and improving the lives of countless animals.

- Environmental Conservation: Through peer-to-peer fundraising, environmental organizations can mobilize their supporters to take action on issues such as wildlife protection, reforestation, and climate change. The collective efforts of passionate environmentalists can lead to positive change for the planet.

- Political Campaigns: P2P fundraising has found its place in the political landscape, allowing candidates and political causes to reach potential voters and supporters directly through their networks. Grassroots fundraising efforts have become instrumental in amplifying the voices of political candidates and movements.

Crowdfunding vs. Peer-to-Peer lending

While crowdfunding and peer-to-peer lending involve raising funds through online platforms, there are some key differences between the two.

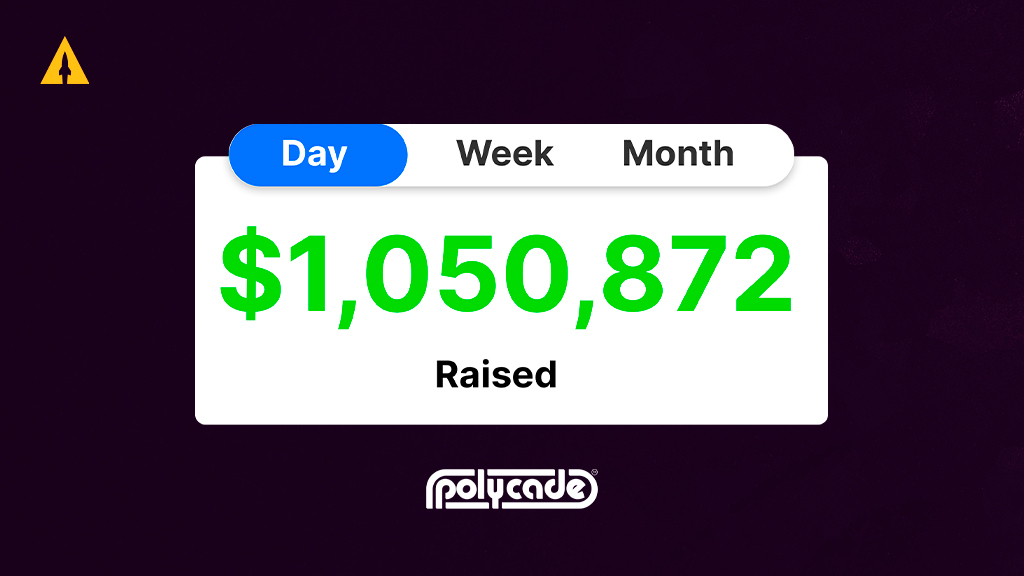

Crowdfunding allows for a wider reach and the potential to raise larger amounts of money due to the involvement of a large number of contributors.

The campaign’s success often depends on engaging and mobilizing a large network of supporters.

Crowdfunding platforms, like Kickstarter or Indiegogo, can provide additional support and resources to help campaigners succeed in their fundraising efforts.

On the other hand, peer-to-peer lending offers the potential for higher returns on investment compared to traditional savings accounts or bonds.

Lenders can earn interest on the money they lend, making it an attractive option for individuals looking for potential financial returns.

Additionally, peer-to-peer lending allows borrowers to access funds without going through traditional financial institutions, benefiting individuals with limited credit history.

Another difference between crowdfunding and peer-to-peer lending is the structure of the campaigns.

Crowdfunding campaigns are usually time-limited and have a specific fundraising goal. In contrast, peer-to-peer lending can have more flexible terms and repayment options. This flexibility allows borrowers to customize their loan terms to fit their specific needs.

Crowdfunding vs. Peer-to-Peer fundraising

Crowdfunding and peer-to-peer fundraising are effective methods for raising funds. Still, they differ in their approach and target audience.

Crowdfunding campaigns are typically initiated by individuals or organizations seeking funds for various purposes, from creative projects and product launches to charitable causes.

Crowdfunding platforms often provide built-in social sharing features, making it easier for supporters to spread the word about a campaign.

This social sharing aspect can significantly increase the reach and visibility of a campaign, attracting a larger number of potential contributors.

On the other hand, peer-to-peer fundraising relies on the efforts of supporters and their personal networks. Nonprofit organizations often use it to support specific programs, initiatives, or causes.

Peer-to-peer fundraising can create a sense of community and engagement among supporters, leading to long-term relationships and ongoing support.

Supporters become advocates for the cause and actively participate in the fundraising process by reaching out to their networks and encouraging others to contribute.

Crowdfunding, Peer-to-Peer lending, and Peer-to-Peer fundraising: which is the right option for you?

When deciding between crowdfunding, peer-to-peer lending, and peer-to-peer fundraising, there are several factors to consider:

- The nature of your project or cause: If your project or cause requires a large initial investment, crowdfunding may be a better option. Crowdfunding allows you to tap into a large pool of potential contributors and raise the necessary funds within a short timeframe.

- Your personal financial goals: If you are looking for potential financial returns, peer-to-peer lending might be more suitable. Peer-to-peer lending offers the opportunity to earn interest on the money you lend, potentially providing higher returns compared to traditional savings accounts or bonds.

- Your network and support system: Evaluate your current network and determine the level of support you have. If you have a strong network of supporters willing to fundraise on your behalf, peer-to-peer fundraising can be highly effective. Supporters become advocates for your cause and actively participate in the fundraising process, increasing the chances of success.

- Your desired level of control and involvement: Crowdfunding allows for more direct engagement with contributors, as you can interact with them through updates, comments, and rewards. On the other hand, peer-to-peer lending involves less direct interaction as the lending process is primarily automated through the online platform.

- The fees and costs of each option: Be sure to account for the fees and expenses associated with each option. Crowdfunding platforms may charge fees, typically a percentage of the funds raised, to cover their costs. Peer-to-peer lending may involve transaction or service fees, which can impact the overall returns on your investment.

Choose your fundraising method wisely

When choosing between peer-to-peer fundraising vs. crowdfunding or peer-to-peer lending vs. crowdfunding, you must remember that all three are powerful fundraising methods, each offering distinct benefits and considerations.

Here’s a quick recap:

- Crowdfunding enables individuals and organizations to reach a wide audience and raise substantial funds for diverse projects, from creative endeavors to social causes.

- Peer-to-peer lending empowers lenders to diversify their investments and potentially earn higher returns while providing borrowers with accessible and competitive financing options.

- Peer-to-peer fundraising fosters community engagement, encouraging supporters to advocate for causes they are passionate about and expand the donor base for nonprofit organizations.

In order to choose the right option, it is essential to consider the nature of your project or cause, your financial goals, the strength of your support network, and your desired level of involvement and control.

By carefully assessing these factors and considering the associated fees and costs, you can maximize your chances of success and make a meaningful impact with your fundraising efforts.