So, you’re looking for the best way to raise funds for your business venture or next big idea.

Chances are you’ve narrowed it down to the two most popular options: crowdfunding and business loans.

Crowdfunding involves raising money from a large number of people through an online platform, like Kickstarter or Indiegogo, while business loans involve borrowing money from a financial institution.

Both options have benefits and drawbacks, and choosing between them will ultimately depend on your individual needs.

Read on as we compare and contrast both options while exploring a third option, peer-to-peer lending, that combines aspects of both.

Contents

Key Takeaways:

- Crowdfunding, business loans, and peer-to-peer loans are all viable fundraising options for anyone looking to raise money for their next project or business venture.

- While all funding options have benefits and drawbacks, crowdfunding is the most hassle-free way to fund your big idea.

- LaunchBoom offers the tools and resources you need to create a successful crowdfunding campaign.

What is Crowdfunding and How Does it Work?

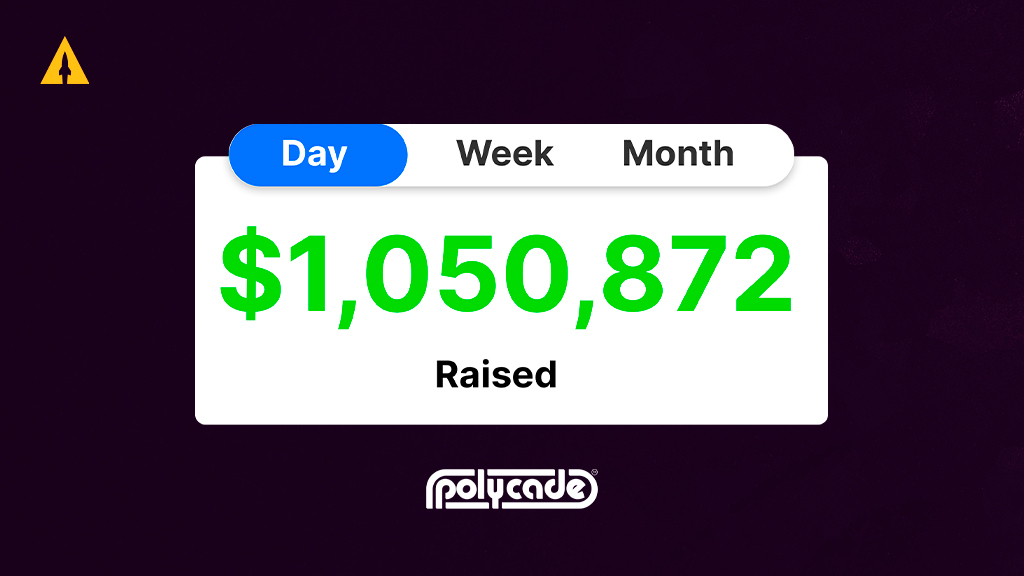

Crowdfunding is a fundraising method that enables individuals and businesses to raise funds for a specific project or venture through contributions from backers who support the project.

The process involves creating a campaign or project on a crowdfunding platform like Kickstarter or Indiegogo, setting a funding goal, and promoting the campaign to potential backers.

Here at Launchboom, we know a thing or two about crowdfunding.

Because it provides a solid alternative to traditional fundraising methods, like loans, crowdfunding has become increasingly popular.

By tapping into the massive audiences that crowdfunding platforms have, crowdfunding allows businesses and individuals to reach many potential backers, many of whom want to be the first to access new and innovative products.

Crowdfunding isn’t free, of course. Most crowdfunding platforms take a percentage of the funds raised as a fee, which can vary depending on the platform.

Compared to traditional fundraising methods, like bank loans, the fees are generally much lower, which is why crowdfunding has become an attractive option for businesses and individuals looking to raise capital.

So, let’s take a deep dive into how crowdfunding works.

The process typically involves several key steps.

First, you create a campaign or project on the crowdfunding platform. It should include a description of the project, the funding goal, and the timeframe for raising funds. Your campaign may also include rewards or incentives for contributors, such as early access to a product or exclusive merchandise.

Once your campaign is live, you can promote it to potential contributors through social media, email marketing, and other channels. Some users use tools like Kickbooster to manage their affiliate, referral, and influencer network.

This is often a critical phase of the crowdfunding process, as the campaign’s success depends on reaching a large audience and generating interest in the project.

As backers come on board, the crowdfunding platform tracks the progress toward the funding goal and provides regular updates.

If the funding goal is not met by the end of the campaign period, the contributors are typically refunded their money, but platforms like Indiegogo allow projects to keep the money they’ve raised even if they don’t meet their goal.

One of the key benefits of crowdfunding is that it allows businesses and individuals to raise capital without giving up equity or control over their venture.

Unlike traditional fundraising methods, which may require the business to give up a percentage of ownership or control in exchange for funding, crowdfunding enables the company to maintain full ownership and control of its venture.

Crowdfunding can also be a valuable tool for market validation, enabling you to gauge demand for your product or service before investing significant resources into development or production.

By generating interest and pre-orders through crowdfunding, you can test the market and make more informed decisions about the viability of your venture.

Benefits of Crowdfunding

Crowdfunding has many benefits, including:

- Access to a large pool of potential backers

- A faster fundraising process than traditional fundraising methods

- The ability to generate buzz and publicity for your brand or business

- Valuable market validation by gauging demand for the product or service

- A low-risk option for businesses, as backers assume the risk

Drawbacks of Crowdfunding

While we’re obviously big supporters of crowdfunding here at LaunchBoom, we recognize that crowdfunding does have its drawbacks, including:

- Setting up and managing a campaign can be time-consuming

- A significant amount of marketing and promotion may be required to generate interest and contributions

- It may not be a viable option for all businesses, particularly those with complex financial needs, or those not offering a specific product

The bottom line is that crowdfunding is a powerful fundraising tool that enables businesses and individuals to raise capital from a large pool of potential backers.

By tapping into the collective intelligence of the crowd, businesses and individuals can generate interest, support, and funding for their ventures without giving up equity or control.

While the crowdfunding process can be complex and requires significant effort to promote and manage, the benefits can be substantial for businesses and individuals looking to launch a new project, particularly when compared to business loans.

What are Business Loans, and How Do They Work?

Business loans are one of the most common forms of traditional financing. They are provided by lenders to businesses to be used for various purposes, including starting a new business, expanding an existing business, or covering day-to-day operational expenses.

These loans typically involve a fixed amount borrowed and repaid over a specific period, with interest and fees added.

You can obtain a business loan from a variety of sources, including banks, credit unions, and alternative lenders.

The application process typically involves submitting a detailed business plan, financial statements, and other documentation demonstrating your ability to repay the loan.

Once approved, you receive the loan amount in a lump sum and begin making regular payments, typically on a monthly basis, over the life of the loan.

Your interest rate may vary depending on factors like your credit score, the loan length, and the type of lender you borrow from.

Business loans can be secured or unsecured.

Secured loans require you to put up collateral, such as property or inventory, which the lender can seize if you fail to repay the loan.

Unsecured loans do not require collateral but often have higher interest rates and more stringent application requirements.

One of the primary benefits of business loans is that they can provide you with a significant amount of capital that you can utilize for a wide range of purposes.

Unlike other forms of financing, such as equity financing, where a business gives up a portion of ownership in exchange for funding, business loans allow the company to maintain full ownership and control over its operations.

Business loans can also be a valuable tool for building credit and improving your business’s financial standing.

By making regular payments on a loan, you can establish a positive credit history and demonstrate your ability to manage debt responsibly, which can help secure future financing on more favorable terms.

However, business loans have quite a few drawbacks.

One of the primary drawbacks is that a business loan can be difficult to obtain, particularly for small businesses that are just starting out or have a poor credit history.

Plus, the interest rates on business loans can be incredibly high, especially for unsecured loans, which can increase the cost of borrowing and impact your business’s cash flow.

Benefits of Business Loans

Although business loans have many drawbacks, they can significantly benefit someone looking to finance their project or venture.

Some benefits of a business loan include the following:

- Quick access to a large amount of capital

- The ability to use funds for a wide variety of business needs

- The opportunity for a business to retain full ownership and control

- The ability to establish or improve a business’s credit score

Drawbacks of Business Loans

Business loans are not for everyone, and there are significant drawbacks to taking out a business loan to fund your next project or business venture, including:

- The application process is often quite lengthy and complicated

- The business may need to provide collateral to secure the loan

- Interest rates and fees can be incredibly high, depending on the type of loan and the lender

- The business is responsible for paying back the loan, regardless of the success or failure of the project or venture

- Defaulting on the loan can have serious consequences, such as legal action or a damaged credit score.

While business loans are a valuable financing option for businesses looking to raise capital for various purposes, providing you with the funds you need to grow and expand while retaining equity and control.

However, the application process can be rigorous, and the interest rates and fees can be high, making it essential for businesses to carefully consider their financing options and choose the option that best suits their needs and financial situation.

Unfortunately, business loans are not always the answer.

What about Peer-to-Peer Lending?

Believe it or not, business loans and crowdfunding platforms aren’t the only ways to raise capital to fund your next big idea.

Peer-to-peer (P2P) lending, also known as social lending, is a form of alternative financing that allows individuals to lend and borrow money directly from each other without the need for traditional financial institutions such as banks or credit unions.

P2P lending platforms act as intermediaries, connecting borrowers with lenders and facilitating the loan process.

P2P lending allows borrowers to create a loan listing on the platform, specifying the loan amount, interest rate, and loan term.

Potential lenders can then browse through the loan listings and choose to invest in the loans that meet their criteria.

Lenders can invest in a portion of the loan, known as a “note,” which can sometimes be as little as $25.

P2P lending is similar to crowdfunding in that, once enough lenders have invested in the loan, the borrower receives the entire loan amount, which is typically deposited directly into their bank account.

The borrower then makes monthly payments to the P2P lending platform, which distributes the payments to individual lenders based on their investment in the loan.

The P2P lending platforms, for their part, make money by charging fees to borrowers and lenders.

Borrowers typically pay an origination fee, which is a percentage of the loan amount and interest on the loan. On the other hand, lenders pay a service fee or percentage of the interest earned on their investment.

One of the main benefits of P2P lending is that it provides borrowers with an alternative source of financing, particularly for those who may not qualify for traditional bank loans.

P2P lending platforms often have less stringent credit requirements than banks and can provide funding more quickly and at lower interest rates.

P2P lending can also be attractive for investors looking for higher returns than traditional savings accounts or CDs.

Investors can earn interest by investing in P2P loans, typically ranging from 5% to 15%, depending on the loan risk and term.

However, P2P lending is not without risk.

P2P lending is an unsecured form of lending, meaning there is no collateral backing the loans. So, there is a higher risk of default. If a borrower defaults on a loan, the lender may not receive their entire investment back.

Additionally, P2P lending platforms are not insured by the Federal Deposit Insurance Corporation (FDIC), which means that the government does not guarantee investments in P2P loans. Therefore, investors should carefully consider the risks and benefits of P2P lending and diversify their investments to minimize risk.

Benefits of Peer-to-Peer Lending

Some of the benefits of peer-to-peer lending include the following:

- Access to a large pool of potential investors

- A faster process than traditional fundraising methods

- A structured loan with a fixed interest rate, similar to conventional business loans

- More flexible loan terms, including lower interest rates and more extended repayment periods

Drawbacks of Peer-to-Peer Lending

Peer-to-peer lending has significant drawbacks, including:

- Interest rates may be higher than traditional loans, depending on the borrower’s creditworthiness

- It may not be a viable option for businesses with complex financial needs

- It may require a significant amount of marketing and promotion to generate interest from investors

- It may not offer the same level of credibility and validation as traditional loans from established financial institutions

- The platform may take a percentage of the funds raised as a fee

P2P lending is a form of alternative financing that allows individuals to lend and borrow money directly from each other without the need for traditional financial institutions.

While P2P lending can give borrowers easy access to financing and investors higher returns, it also comes with risks.

Therefore, the decision to participate in peer-to-peer lending, either as a borrower or an investor, should be carefully considered.

Crowdfunding vs. Business Loans vs. P2P Loans: Which is the Better and Why?

We admit we may be a little biased, but while crowdfunding, traditional business loans and P2P loans have benefits and drawbacks, crowdfunding is often the best option for businesses.

That is especially true for businesses just starting out or looking to fund a specific project.

Crowdfunding provides access to a large pool of potential investors, which can help generate buzz and publicity for the business. It is also a low-risk option, as backers assume the risk and can provide valuable market validation by gauging demand for the product or service.

Crowdfunding also offers a much faster process than traditional fundraising methods and requires less collateral than conventional loans.

Of course, there are instances where business loans and peer-to-peer lending can be viable options.

For example, a business loan may be the best option for established businesses that need a large amount of capital and can provide collateral to secure the loan.

Business loans also provide access to a more structured loan with a fixed interest rate, which can help the business better plan and manage its finances.

However, the application process for business loans can be lengthy and complicated, and the business is responsible for paying back the loan regardless of its success or failure.

For businesses that want the benefits of both crowdfunding and business loans, P2P loans may be the way to go, but it is certainly not the best option for all businesses.

Ultimately, deciding which fundraising option to choose will depend on your specific needs and goals and your ability to provide collateral and manage loan repayment.

We say you should always choose the path of least resistance; in most cases, that path is through crowdfunding.

Want to increase the success of your crowdfunding campaign?

Let LaunchBoom show you how!