Your product is finally coming to life. You chewed over this idea for ages. You spent countless hours developing your first prototype. And now you’re wondering, “Am I ready to hit the crowdfunding market?”

It’s time for market research.

Right now, you have a product that you think people want. You don’t know that people want it yet.

Market research helps you understand the crowdfunding landscape, learn from competitors, and gain confidence in your product and audience. It’s the foundation of a successful campaign. Today, let’s learn how to conduct market research for your crowdfunding project.

Contents

- Understanding the importance of market research in crowdfunding

- Step 1: Identifying your target audience

- Step 2: Analyzing the competition and market environment

- Step 3: Conducting primary research for validation

- Final thoughts

- Conducting market research for your crowdfunding project: Frequently asked questions

Understanding the importance of market research in crowdfunding

In 2019, Heshika Deegahawathura came to us with SPRYNG, a wireless compression wrap.

Initially, he wanted to market his product to athletes as an advanced muscle recovery tool. But SPRYNG also improves circulation problems common in people who spend most of the day standing or sitting — essentially, people at the complete opposite end of the physical activity spectrum.

So who did we target?

That’s where market research came in. We tested two different ads, one targeting athletes and another targeting people with circulation problems.

The ads targeting people with circulation problems did much better. We refined our positioning and increased marketing spend into that audience. The research paid dividends — SPRYNG raised $1,075,782 on Kickstarter and Indiegogo InDemand.

Market research propelled our campaign to success. If you don’t study the crowdfunding market and validate market demand for your product, your campaign will topple.

Here are three steps to conducting an effective market analysis for your crowdfunding campaign:

- Understanding the crowdfunding market and your target audience

- Completing a crowdfunding competitive analysis

- Conducting primary research and validating crowdfunding ideas

Step 1: Identifying your target audience

Knowing your target audience is crucial. If you don’t, you can’t accurately position your product, you can’t validate market demand, and you doom your campaign from the start.

It sounds dire, but it’s true. The #1 reason that products don’t succeed is poor product positioning.

To identify your target audience, start by asking yourself two questions:

- What problem does my product solve?

- Who experiences this problem?

What problem does my product solve?

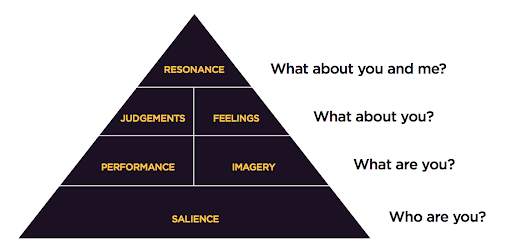

To figure out what problem your product solves, let’s refer to the Consumer-Based Brand Equity (CBBE) pyramid.

The underlying principle of CBBE is that you don’t own your brand, consumers do. Your brand is something that lives in their mind. To understand what your product is and why it matters, put yourself in the consumer’s shoes.

Let’s try an experiment. We’ll throw out a brand you most likely know. Pay attention to what appears in your mind’s eye — what images, associations, sensations, and experiences? Here we go…

Starbucks.

Believe it or not, your brain has climbed the entire CBBE pyramid in the blink of an eye. Moving from bottom to top, here are the associations that might have popped up:

Salience: sells coffee

Performance: affordable, locations everywhere, fast, easy experience, same coffee every time

Imagery: green mermaid logo, cozy coffee shop, coffee with cream

Judgments: consistent, friendly staff, coffee tastes decent

Feelings: warmth, caffeine buzz, trustworthy, dependable, loyal

Resonance: I will choose Starbucks and go with friends and family because I trust the company and consistent experience I get

These associations are unconscious and lightning-fast, but Starbucks spent years of research and millions of dollars to occupy this space in our minds.

Look at your product through the lens of CBBE. What are you, and how do you do it? How should consumers think and feel about your brand?

To help you answer these questions, we created the LaunchBoom Product Positioning Questionnaire. Download it here to get started.

Who experiences this problem?

Once you complete the questionnaire, it’s time to form hypotheses about your target market.

Identify the top three audiences you believe will be most interested in your product. For example, here’s an audience we identified for the LoftTek Adventure Jacket:

Audience #1: Snowsport enthusiast

Age range: 25-44

Gender: Male/female

Interests: Atomic skis, Fischer, snowboard, cross-country skiing, Snowboard Magazine, Freeskiing, Transworld Snowboarding, Freeskier Magazine, backcountry skiing, ski mountaineering, alpine skiing, freestyle skiing, Burton snowboards

Geographic location: United States

Keep in mind, everything up to this point is pure hypothesis. Crowdfunding market research is all about challenging everything you think you know about your product.

Create different ads and pit them against each other. Test and retest variations in copy, imagery, and audience. Don’t be afraid to revisit the CBBE pyramid again and again in your crowdfunding industry analysis.

Step 2: Analyzing the competition and market environment

The purpose of a crowdfunding competitive analysis is to feel out your competitors’ marketing strategies and learn from their strengths and weaknesses. Don’t fall into the trap of thinking you have to reinvent the wheel. Keep it simple and model what works!

Before you draft your campaign page, search for successful campaigns similar to yours on Kickstarter and Indiegogo. Pay attention to how they organize their content, speak to consumers, and design their creative.

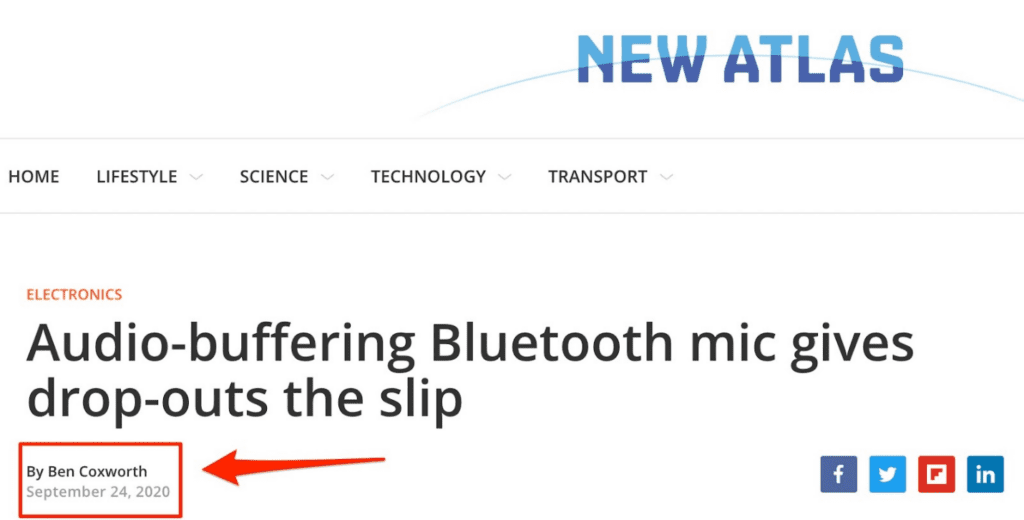

Similarly, when you create your media contact list for PR, start with your competitors.

For example, let’s say your product is Bluetooth microphones. On Kickstarter, you might see our campaign for Hooke Lav. It’s a sleek, wireless mic with pro-grade sound, so it occupies a similar market. Plus it raised $580,753 — not bad!

As you scroll down Hooke Lav’s campaign page, keep your eyes peeled for a media logo cloud. A media logo cloud shows all the media sites that covered the product. The one for Hooke Lav looks like this:

Now you have the names of twelve different media sites that have covered a similar product and will likely be interested in yours.

Next, find the actual articles written by these media sites and find the names of the authors. Connect with them on LinkedIn (or better yet, get their email address), introduce yourself and your product, and pitch them your project.

Remember that cold outreach is always a numbers game. Many will say “no” or simply not respond. But if you do your research, you’ll know where to aim to maximize your chances of success.

Keeping up with market trends

We can’t conduct a crowdfunding trends analysis without bringing up influencers. Love them or hate them, they drive serious revenue in today’s consumer market.

- Influencer marketing is a $22.1 billion industry

- 8 out of 10 consumers have purchased a product after seeing it recommended by an influencer

- 36% of brands say influencer content outperforms branded content

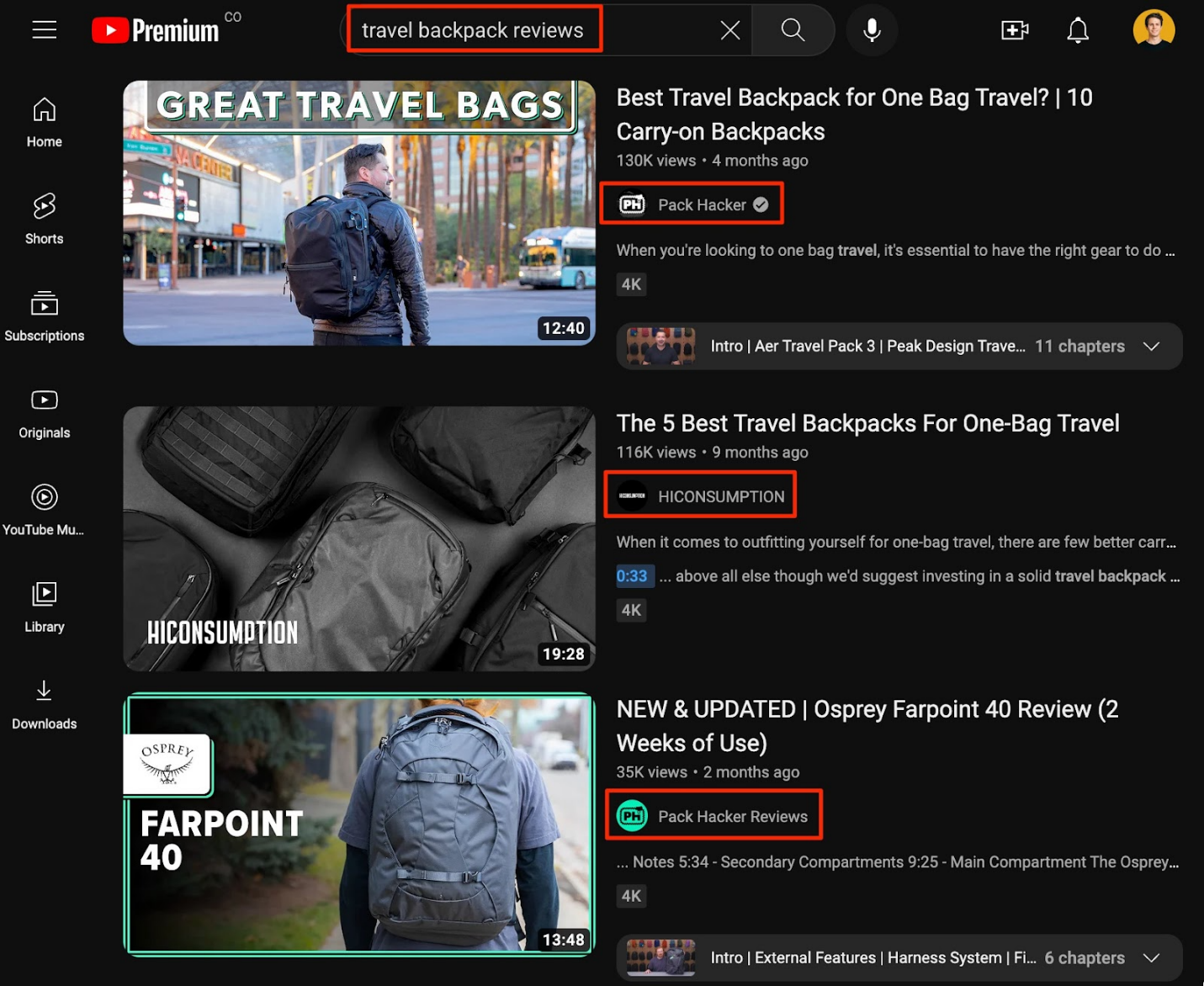

How do influencers factor into crowdfunding market research? We’ll use another hypothetical example. Let’s say you’re launching a new travel backpack.

First, start with YouTube. Search for travel backpack reviews. Immediately, you’ll see a list of different YouTube channels with audiences that may overlap with yours.

On Instagram and TikTok, type in the hashtag #travelbackpack. You’ll see different influencers who used that hashtag.

With choosing the best influencers, we like to use the “three R’s.”

- Relevance: how much an influencer’s audience aligns with your brand/product

- Reach: the number of people who will be exposed to the message

- Resonance: the influencer’s ability to drive measurable results with their audience

As you research the influencers in your product market, use the three R’s to hone in on partnerships that are relevant to your audience, increase your reach, and get viewers to act.

Step 3: Conducting primary research for validation

The ultimate goal of crowdfunding market research is to validate demand for your product. That’s what sets crowdfunding apart from the traditional product launch model — you get to know the market and your audience before sinking too much money in product design and manufacturing. Before you invest in inventory, you need to find out:

- How much does it cost me to acquire a customer?

- How much is the market willing to pay for my product?

- What questions and concerns does the market have about my product?

How much does it cost me to acquire a customer?

Customer acquisition cost (CAC) is key to understanding your crowdfunding statistics. To calculate CAC, divide the cost of all your digital marketing efforts by your total number of customers.

For example, if you spend $15,000 monthly on digital advertising and yield 12,000 customers yearly:

CAC = $15,000 monthly spend * 12 months in a year / 12,000 customers = $15.00 per customer.

That means it costs you $15.00 to acquire one customer through digital advertising.

What price is the market willing to pay?

Willingness to pay (WTP) is a longstanding staple in behavioral economics and no less important in your crowdfunding market research. WTP is the maximum price a customer will pay for your product or service.

Primary research is your best tool for discovering WTP. Design focus groups and surveys for your crowdfunding campaign. What value do consumers see in your product? How much are they willing to pay for it?

Secondary research is helpful too. Look at your competitors. What are the highest priced and lowest priced brands in your market? What is your value proposition relative to your competitors? Knowing the competitive landscape helps you set your funding goal and develop pricing and reward strategies.

What questions and concerns does the market have about my product?

On launch day, you don’t want to be scrambling backwards trying to squash concerns you should have seen coming.

Focus groups and surveys help you uncover questions and concerns people might have about your product. Your competitors’ Frequently Asked Questions, customer reviews, blogs, support forums, and social media platforms are also treasure troves of information.

Once you have this intel, you want to preemptively overcome concerns and doubts through your messaging.

For example, our client The Neck Hammock claims to provide neck pain relief in 10 minutes or less. We predicted people would ask:

- Is there scientific evidence of why it works?

- What credibility does the person have that created it?

- Are there testimonials from people that have used it?

We tackled all of this in our campaign messaging:

- Is there scientific evidence of why it works? We broke down the science behind Cervical Traction and how The Neck Hammock works.

- What credibility does the person have that created it? We included a personal message from the founder, Dr. Steve Sudell, to emphasize his credibility as a doctor and physical therapist.

- Are there testimonials from people that have used it? We compiled written and video testimonials from Dr. Sudell’s clients.

These proactive efforts to build trust and credibility went a long way. The Neck Hammock raised $1,642,934 in crowdfunding revenue.

Final thoughts

A crowdfunding market analysis is crucial for understanding your product, competitors, and audience. Today, we discussed:

- Using the CBBE pyramid to develop positioning and targeting

- Analyzing competitors for PR and influencer strategy

- Validating market demand through primary and secondary research

Conducting market research for your crowdfunding project: Frequently asked questions

What are the best crowdfunding project research tools?

Use primary and secondary research tools to learn more the crowdfunding market:

- Survey your existing customers

- Test targeted ads

- Organize focus groups

- Monitor your competitors

How do you determine your target audience in crowdfunding?

To determine your target audience, ask yourself 1) “What problem does my product solve?” and 2) “Who experiences this problem?” The LaunchBoom Product Positioning Questionnaire is a super handy tool for determining what space you want to occupy in the consumer’s mind.

What are some best practices in crowdfunding research?

Crowdfunding campaign research is all about trial and error. It’s tempting to get tunnel vision on your product, but the market doesn’t yet understand it the way you do. Be prepared to test and retest your hypotheses about your brand image and target audience.

In his book The Lean Startup, Eric Ries calls it the Build, Measure, Learn loop.

Successful entrepreneurs know that business is a never-ending set of experiments. Build an experiment. Measure the data. Learn from the data.