Indiegogo, one of the world’s leading crowdfunding platforms, has lent to a significant number of borrowers since its inception. By understanding Indiegogo’s lending model and examining the scale of its borrower base, we can gain valuable insights into the platform’s success and influence in the lending industry. Additionally, exploring the factors that influence borrower numbers on Indiegogo and comparing it to other crowdfunding platforms will provide a comprehensive understanding of its unique position in the market. Finally, we will discuss the future of borrowing on Indiegogo, including predicted trends and potential challenges and opportunities that lie ahead.

Contents

Understanding Indiegogo’s Lending Model

Before delving into Indiegogo’s borrower numbers, it is essential to grasp the basics of crowdfunding. Crowdfunding is a financial model that connects individuals or organizations in need of funds with a large number of potential contributors. Indiegogo, as a crowdfunding platform, enables borrowers to create campaigns and solicit financial support from the public.

When it comes to crowdfunding, there are various platforms available, each with its own unique features and approaches. However, Indiegogo stands out from the crowd due to its incorporation of lending into its funding options. While traditional crowdfunding platforms focus on donation-based support, Indiegogo has expanded its offerings to include loan-based crowdfunding as well.

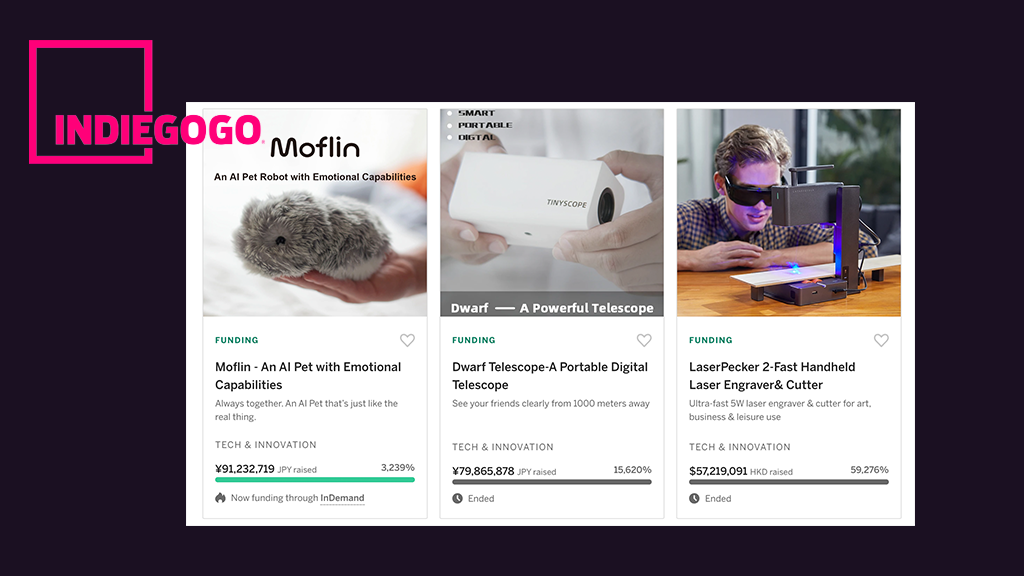

In a typical crowdfunding campaign, borrowers usually offer rewards or incentives to entice contributors. These rewards can range from pre-ordering a product or receiving exclusive access to project updates. By utilizing this model, borrowers on Indiegogo can raise funds for a wide variety of purposes, including business ventures, creative projects, or charitable causes.

The Basics of Crowdfunding

Crowdfunding has revolutionized the way individuals and organizations raise funds for their projects or ventures. It provides a platform for them to showcase their ideas and connect with a global audience of potential supporters. The concept of crowdfunding is rooted in the belief that many small contributions can add up to a significant amount, making it possible for even the most ambitious projects to become a reality.

One of the key advantages of crowdfunding is its ability to democratize the funding process. It allows anyone with a compelling idea or cause to seek financial support directly from the public, bypassing traditional gatekeepers such as banks or venture capitalists. This opens up opportunities for individuals who may not have access to traditional funding sources, leveling the playing field and promoting innovation.

Furthermore, crowdfunding campaigns often foster a sense of community and engagement. Supporters not only contribute financially but also become emotionally invested in the success of the project. They become part of a larger network of like-minded individuals who share a common interest or belief. This sense of belonging can lead to long-term relationships and ongoing support for the borrower beyond the initial campaign.

Indiegogo’s Unique Approach to Lending

Indiegogo’s decision to incorporate lending into its crowdfunding model adds an additional layer of flexibility for borrowers. While donation-based crowdfunding is still a popular choice, the option to offer loans provides an attractive alternative for those seeking capital to start or expand their ventures.

With loan-based crowdfunding, borrowers have the opportunity to repay their supporters with interest over time. This creates a win-win situation, as borrowers can access the funds they need while providing a potential return on investment for their supporters. It also enables borrowers to establish a credit history and build relationships with lenders, which can be valuable for future financial endeavors.

Indiegogo’s lending model opens up new possibilities for borrowers who may not have considered crowdfunding as a viable option before. It allows them to tap into a broader pool of potential supporters who are willing to invest in their vision and share in the potential financial rewards.

Additionally, the inclusion of lending in Indiegogo’s platform aligns with the evolving landscape of alternative finance. As traditional lending institutions become more stringent in their lending criteria, borrowers are increasingly turning to alternative sources of funding. Indiegogo’s loan-based crowdfunding provides a viable solution for those who may not meet the requirements of traditional lenders but still have a compelling project or business idea.

In conclusion, Indiegogo’s lending model expands the possibilities of crowdfunding by offering borrowers the option to repay their supporters with interest. This unique approach sets Indiegogo apart from other crowdfunding platforms and provides borrowers with additional flexibility and opportunities for financial support.

The Scale of Indiegogo’s Borrower Base

When analyzing the borrower numbers on Indiegogo, it is evident that the platform has facilitated a substantial volume of lending activities. Let’s take a closer look at the numbers and explore the geographic distribution of Indiegogo’s borrowers.

A Look at the Numbers

Indiegogo has successfully facilitated thousands of loans to borrowers worldwide. Through its innovative lending model, it has paved the way for countless individuals to turn their dreams into reality. The diverse range of projects funded on Indiegogo speaks to its broad appeal and widespread impact.

Geographic Distribution of Borrowers

Indiegogo’s borrower base is not limited to a specific region but spans across the globe. The platform has empowered borrowers from various countries, enabling them to access the funds they need to bring their ideas to life. Whether it’s a technology startup in Silicon Valley or a social enterprise in a remote village, Indiegogo has created opportunities for borrowers from all corners of the world.

Factors Influencing Borrower Numbers on Indiegogo

Several factors contribute to the number of borrowers on Indiegogo. By examining the role of project type and industry, as well as loan terms and conditions, we can gain insights into the platform’s attractiveness to borrowers.

The Role of Project Type and Industry

The types of projects featured on Indiegogo play a significant role in attracting borrowers. The platform accommodates a wide range of sectors, including technology, fashion, film, and social impact initiatives. Its flexible nature allows borrowers from various industries to find a suitable audience and receive the financial support they need.

The Impact of Loan Terms and Conditions

Loan terms and conditions are crucial factors that influence borrower interest on Indiegogo. Offering attractive interest rates, flexible repayment options, and clear terms can increase the likelihood of borrowers choosing Indiegogo as their preferred crowdfunding platform. Additionally, providing detailed information about the potential risks and rewards associated with a loan can instill confidence in borrowers, encouraging them to seek funding through Indiegogo.

Comparing Indiegogo to Other Crowdfunding Platforms

While Indiegogo has established itself as a prominent crowdfunding platform, it is essential to compare its borrower numbers to those of other platforms to gain a comprehensive perspective.

Borrower Numbers Across Different Platforms

When examining borrower numbers across different crowdfunding platforms, Indiegogo stands out for its extensive reach and borrower engagement. While other platforms have their merits, Indiegogo’s unique lending model and worldwide presence attract borrowers searching for diverse funding options.

Unique Features of Indiegogo That Attract Borrowers

Indiegogo’s borrowers are drawn to its unique features that set it apart from other crowdfunding platforms. The ability to offer loans in addition to rewards-based crowdfunding gives borrowers flexibility in their fundraising efforts. Indiegogo’s global community, extensive marketing resources, and user-friendly interface further contribute to its popularity among borrowers.

The Future of Borrowing on Indiegogo

As Indiegogo continues to evolve and shape the crowdfunding landscape, it is crucial to examine the future of borrowing on the platform.

Predicted Trends and Growth

The future of borrowing on Indiegogo looks promising, with an anticipated increase in borrower numbers. As more individuals and organizations recognize the benefits of crowdfunding, Indiegogo’s platform is expected to attract a growing pool of borrowers from diverse backgrounds and industries. This expansion will contribute to the platform’s ongoing success and its ability to make a significant impact on the global lending market.

Potential Challenges and Opportunities

While Indiegogo’s path forward seems promising, it is essential to address potential challenges and seize opportunities for improvement. Ensuring robust borrower protection mechanisms, enhancing transparency, and further exploring partnerships with financial institutions are key areas to focus on. By capitalizing on these opportunities and addressing challenges effectively, Indiegogo can solidify its position as a leading crowdfunding platform for borrowers.

In conclusion, Indiegogo has lent to a substantial number of borrowers since its inception. Its unique lending model, global reach, and diverse range of projects have attracted borrowers from around the world. By considering the factors influencing borrower numbers and comparing Indiegogo to other crowdfunding platforms, we gain valuable insights into its position in the lending industry. Looking ahead, Indiegogo’s future as a prominent borrowing platform seems promising, with predicted growth and a range of opportunities to be explored.